What's the Future of Shopping Malls?

The mall is dead. Or is it? In the face of unprecedented change and uncertainty it is easy to simplify what is on the horizon. For malls to die one thing for sure needs to happen, people need to stop shopping in stores. Even during a pandemic that has cast the biggest threat to offline retail perhaps in history the majority of retail sales still take place in stores. In the third quarter of 2020 85.7% of retail sales took place in stores in the United States. Online sales are up significantly, by 36.7% in the third quarter, but the surge in eCommerce does not come close to eclipsing brick and mortar shopping.

One of the things the COVID-19 pandemic has shown us is that as human beings we enjoy the mundane, especially when we are with others. How many people wish they could go back to a time when we thought nothing of a trip to a shopping mall on a Saturday afternoon with a friend to grab a coffee before an afternoon of shopping? Gathering places like malls are part of the fabric of society, bringing us together and giving us something to do. If you are now spending more time baking or playing chess you realize what an important role those “mundane” trips to the mall have served.

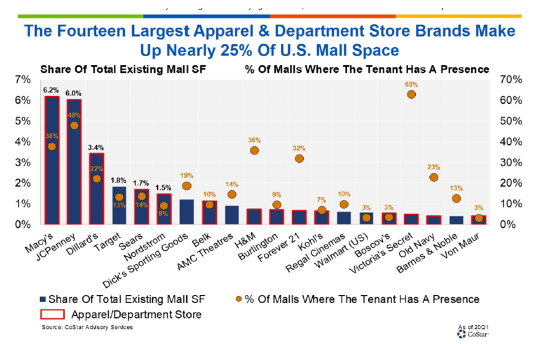

Now let’s move on to the real problem, the types of stores in malls. Many, but not all, of the stores in malls are dying. This is not a new phenomenon it has been happening for quite some time. The traditional concept of a mall revolves around an anchor tenant that is responsible for drawing traffic into the mall. Historically anchor tenants have been department stores.

In the past on a Saturday afternoon parents would get the family into the car and drive to the nearest Sears department store. If this was 1990 when Sears and Walmart were nearly the same size the problems facing mall owners today would not exist. But it is not 1990 its 2020.

With many department stores facing declining revenue for years the pandemic pushed several of these retailers over the edge causing JCPenney, Lord & Taylor and Neiman Marcus to file for bankruptcy this year. In Canada department store retailer Hudson’s Bay stopped paying rent during the pandemic signally it is in financial trouble.

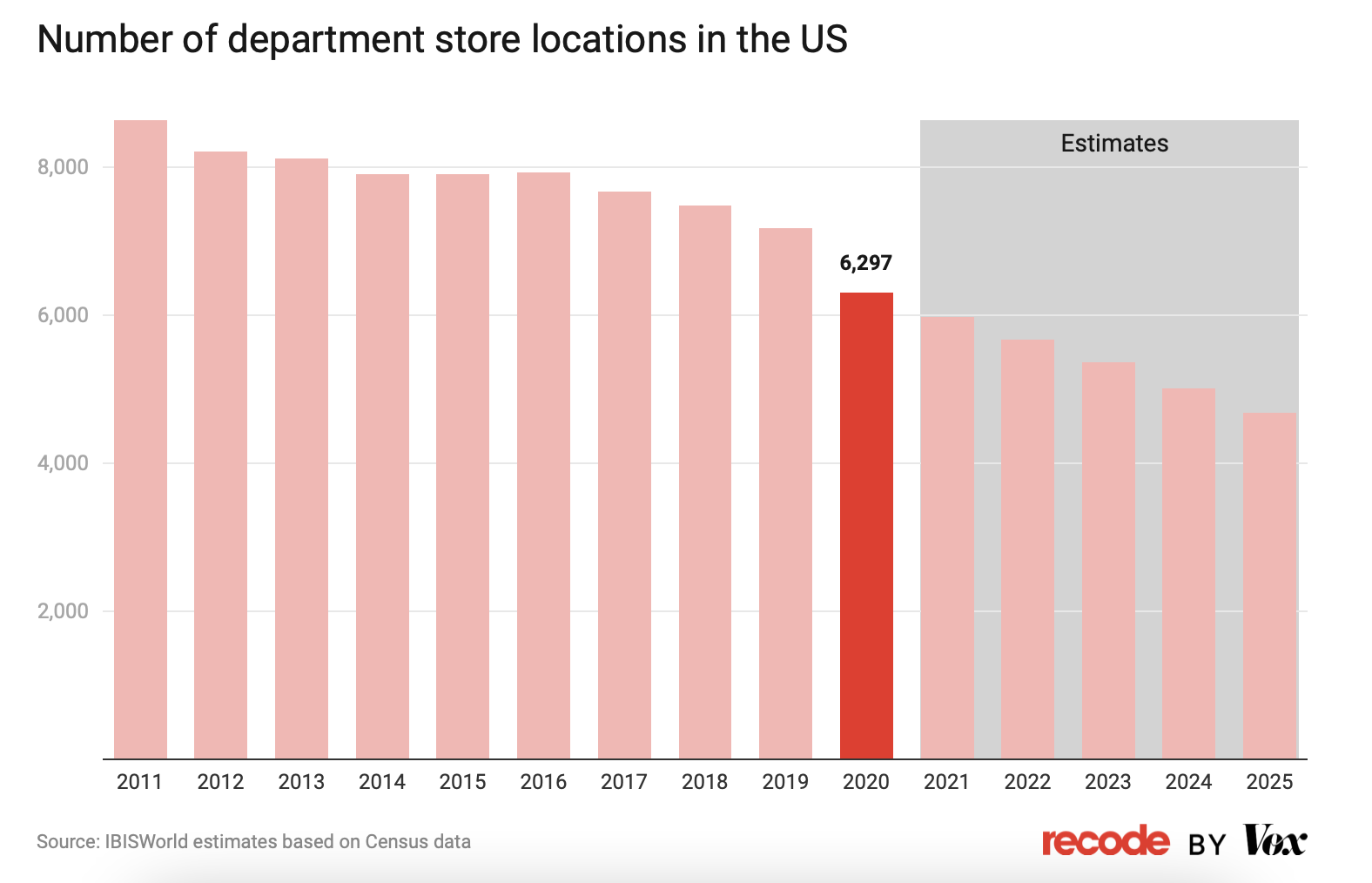

Even though bankruptcy is not the end of the road for all of these retailers the role department stores have held in malls will continue to diminish. By 2025 it is expected that there will be 2,000 fewer department stores.

If only department stores were the only woes facing mall operators. Malls are also filled with clothing stores. That’s an issue. Even before the pandemic began Morgan Stanley said that clothing sales are in a “structural decline”. The pandemic has only accelerated trends like a movement towards more casual clothing. Retailers like Banana Republic and Ann Taylor, mall staples, are in deep trouble as fewer people wear formal workwear. Perhaps we have hoodie wearing Mark Zuckerberg to thank for this.

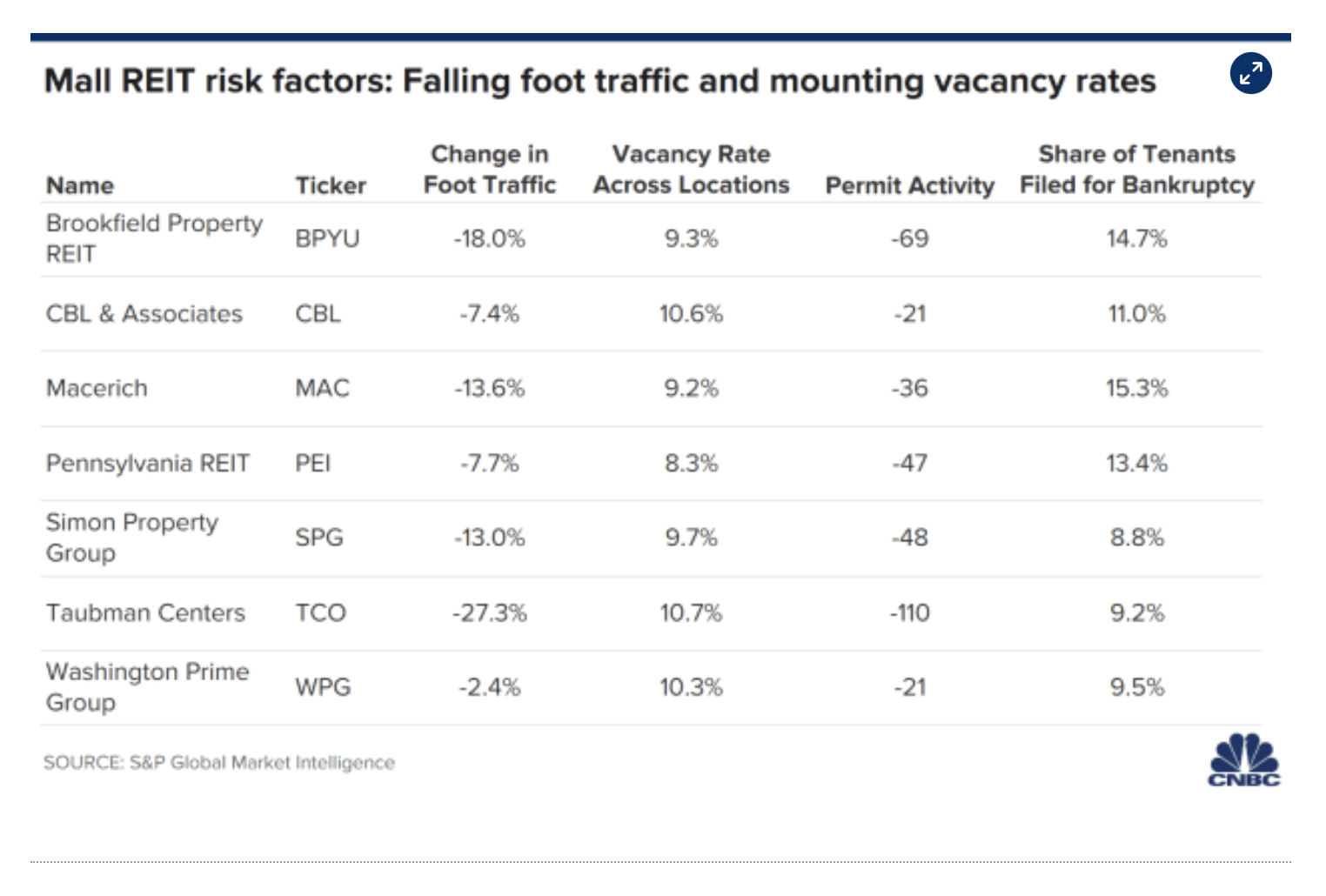

The reality is that mall operators have struggled to keep up with trends in consumer behaviour and spending that have been apparent for years. In November of this year two mall owners CBL & Associates and Pennsylvania REIT, filed for Chapter 11 protection. A recent report by S&P Quantamental Research group said that five more mall owners face exceptional risks: Simon Property Group, Taubman Centers, Brookfield Property REIT, Macerich and Washington Prime Group. Some of the factors that put these mall owners at high risk include declining foot traffic, rising vacancy rates, lower building permit activity and tenants filing for bankruptcy protection.

The pandemic has also left millions of Americans wondering how they are going to pay for basic items like food, transportation and housing. These cash strapped consumers are not looking to shop at Macy’s or JCPenney but at lower priced retailers like Walmart and Target. While many like to focus on the rise of online shopping as the reason for why consumers are shopping less at malls that is not entirely true. As the New York Times writes: “over the 14 years through 2013, Amazon added $38 billion in sales while Costco added $50 billion and the Sam’s Club division of Walmart added $32 billion. Amazon had the higher growth rate, but the bigger problem for most brick-and-mortar stores was other, larger brick-and-mortar stores.” That sentiment is still true.

Walmart and Target are like the department stores of this new era. Whether its clothing or electronics you no longer need to go to a department store to pick up those items. They are easily found at big box retailers and at lower prices. Consumer spending has shifted from department stores to big box retailers which have many off mall locations. Target is one of the big beneficiaries of this shift, gaining $6 billion in market share in 2020 alone.

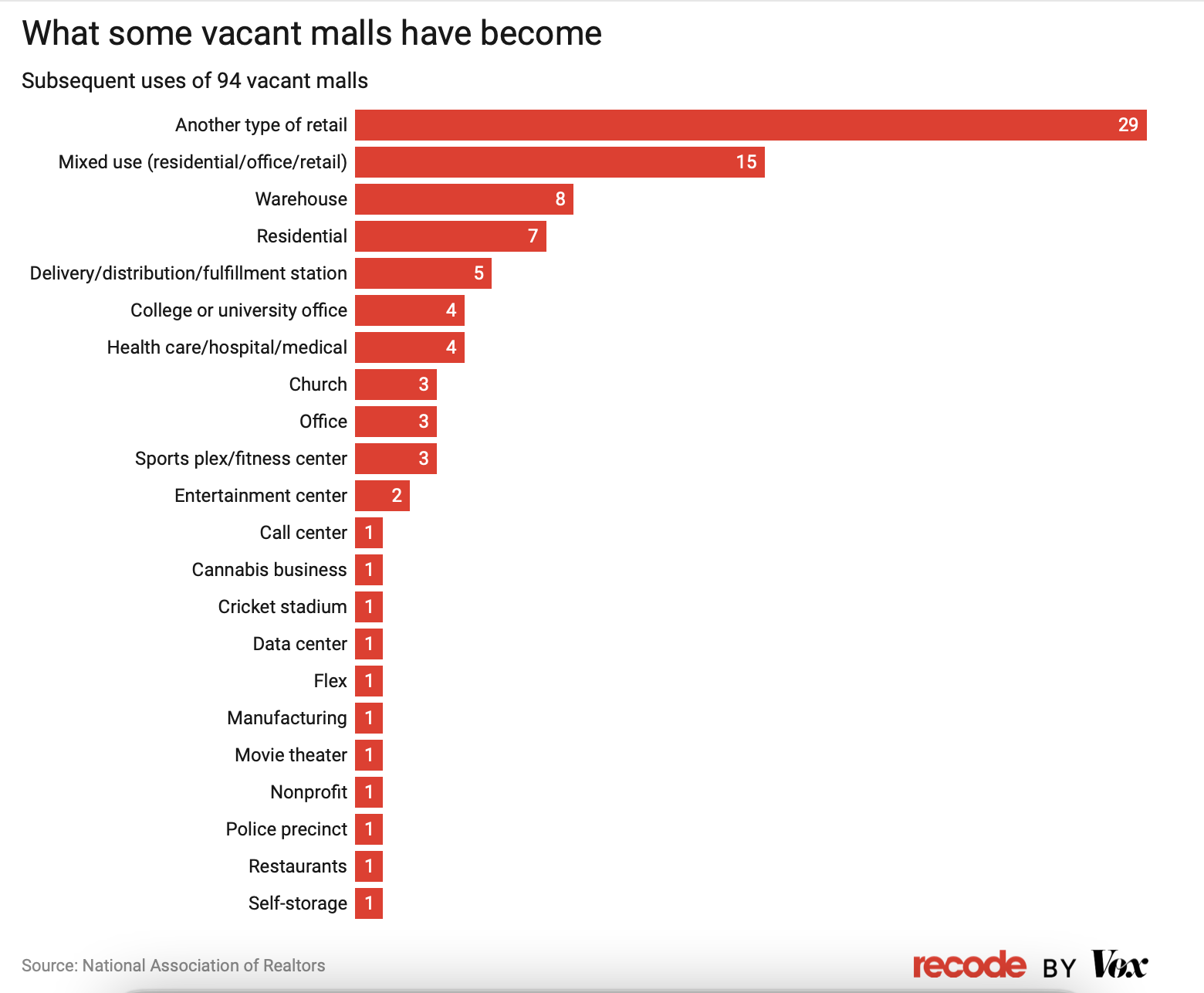

So now that many of the stores that were once mall staples are going away and dollars are moving elsewhere what does the mall of the future look like? Based on a Recode study abandoned mall space will likely fall into a few categories: traditional retail, mixed use (think condos and offices), non-traditional retail like restaurants or apartments; or warehouses and fulfillment centres for eCommerce retailers.

All of this is to say that malls are not going away. But there will be less of them. Coresight Research estimates that one quarter of the 1,000 malls located in the United States will close within three to five years. Expect to see fewer department stores, more office towers and hopefully more relevant stores in the future.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox