6 Reasons Walmart’s eCommerce Strategy is Winning

2020 is the year when the eCommerce narrative shifted in a major way. Before everyone was focused solely on Amazon but as retailers were forced to shift sales online during the COVID-19 pandemic a number of retailers came to the forefront with their eCommerce savvy and Walmart is one of those retailers. The 61 year old retailer has stood out for taking a challenging situation brought on by the pandemic and turning it into an area of strength.

One of the things Walmart has done very well is it has focused on its own assets and how to best leverage them. Take its store network. For many years analysts were saying stores are dead but if Walmart didn’t start testing grocery pickup back in 2013 its grocery pickup services would not have performed so well when put to the test during the pandemic and now that the pandemic is over.

Walmart’s strength in eCommerce can also be seen in its results. Walmart’s eCommerce sales were up 23% in the fourth quarter of 2023 and Walmart’s eCommerce sales passed $100 billion for the first time last year. Walmart is now the second largest eCommerce retailer in the United States behind Amazon with eCommerce making up over 18% of Walmart’s sales. While Walmart trails Amazon by a wide margin in online sales Walmart is gaining ground. If you want to learn more about what has contributed to Walmart’s strong eCommerce performance then read on.

1. Omni-channel retailing is working. The secret to eCommerce success turns out to be….stores. Who would have thought having a network of stores would be so critical to selling merchandise online? Walmart had this foresight and a decade ago in 2013 it started testing a grocery pickup service. Since 90% of the United States’ population lives within 10 miles of a Walmart store this move has become a game changer for the retailer.

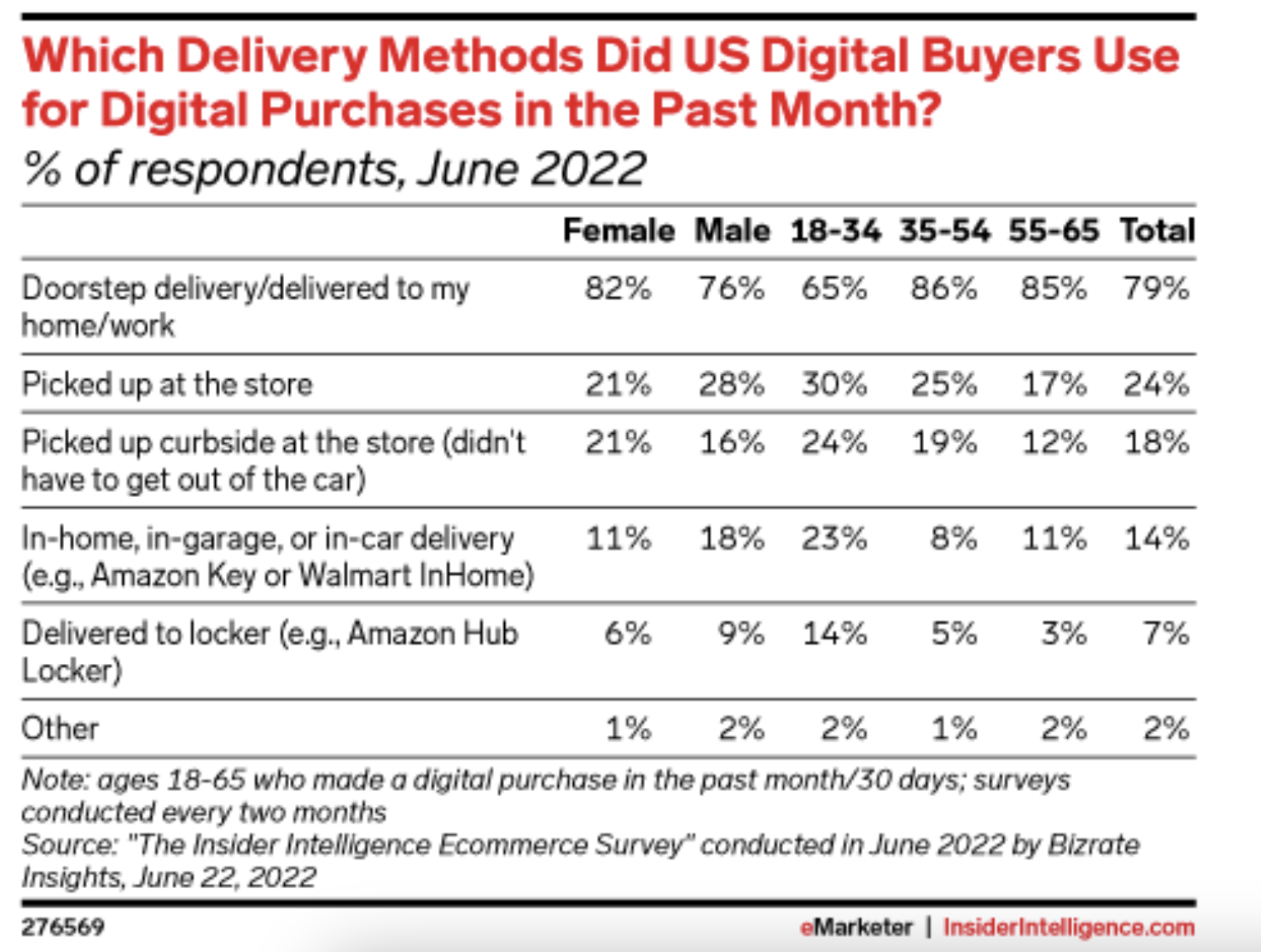

Consumers love shopping online but what they really want is control. Control over where and how they receive their online orders.

Be honest, before the pandemic weren’t you part of the vast majority of consumers that had never tried curbside pickup? Instead of waiting and wondering exactly when your order from Amazon is going to arrive Walmart’s pickup services remove that uncertainty. This service is also beneficial for consumers worried about their goods being stolen after they are dropped off. More than 1.7 million packages are lost or stolen each day in the United States with a third of consumers reporting they have had a package stolen.

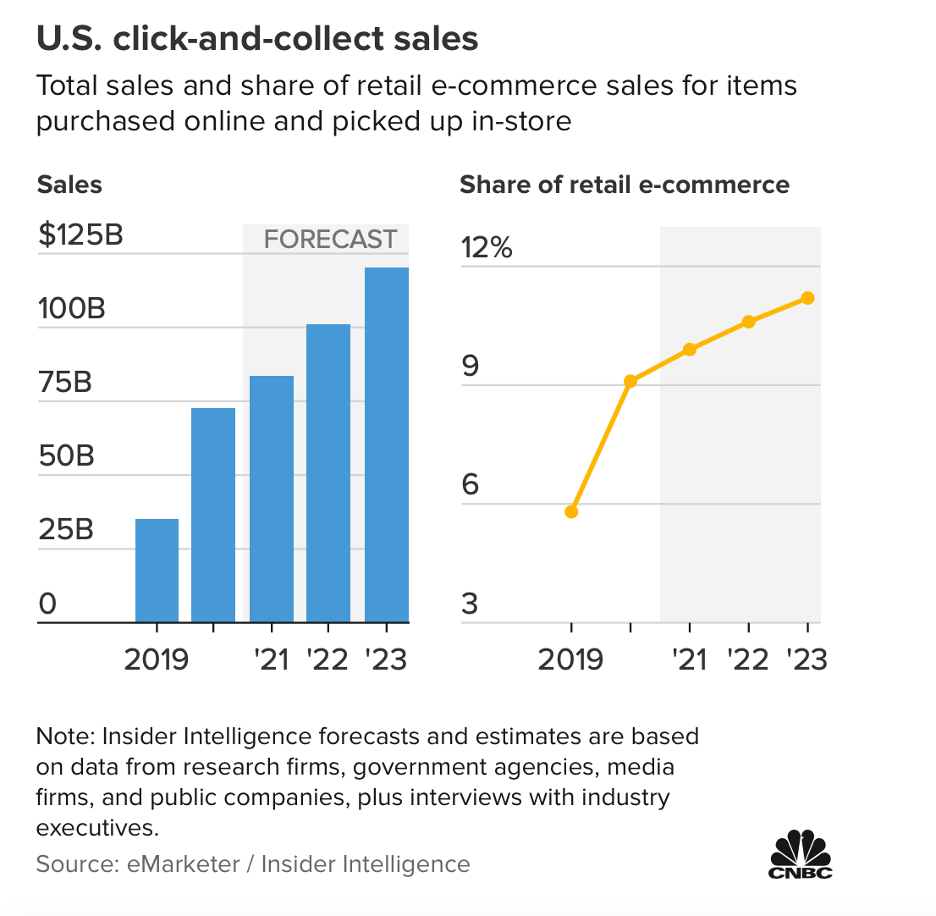

The popularity of pickup services has challenged the notion of what consumers want from eCommerce. It seems like a misnomer that someone will place an order online at home and then will put on their jacket get into their car and go to pick it up. But that is exactly what is happening and these services continue to grow in popularity.

“Having a wide range of fulfillment options, including delivery to home, collection from store – and by using stores for fulfillment – allowed Walmart to ramp up capacity in a way that many other players struggled to do. We also believe that by using stores effectively, Walmart mitigated some of the higher costs associated with the online channel” said Neil Saunders, Managing Director at GlobalData Retail. That sentiment was echoed when Walmart’s former CFO Brett Briggs said: “it is a big advantage being an omnichannel retailer and I think that is showing right now. We were able to quickly use stores to fill online orders.” Approximately a quarter or $20.4 billion of all click and collect purchases made in the United States in 2021 were fulfilled by Walmart.

Customers that shop multiple channels at Walmart are also better for its business. “We’ve shared before — if people buy in-store and online with Walmart.com, they generally spend twice as much and they shop in-store more often,” said Doug McMillon Walmart’s CEO.

Omni-channel retailing is one area where Amazon actually lags other retailers. Stores are so important in categories like groceries that Amazon opened a new brick and mortar grocery chain, Amazon Fresh in 2020 in the middle of a pandemic, demonstrating that stores are still a critical part of any retailer’s eCommerce strategy. But it will take Amazon many years before it has the kind of store network Walmart has where grocery pickup is available at over 4,000 Walmart locations. “Having a short last mile is an important component in e-commerce and having stores be able to deliver what historically would have been an e-commerce order or a food delivery order or the combination of the two is really helping the brand,” said John Furner, CEO and president of Walmart U.S.

2. Consumers are looking for value. Walmart is one of the largest retailers in the world for a reason it capitalizes on the consumer’s desire for value. While everyone focuses on same and next day delivery at the end of the day no matter how fast a retailer delivers merchandise no one is going to buy it if it isn’t what the customer wants. Today’s consumer is strapped for cash. They were struggling financially before the pandemic and then the pandemic hit making it even more difficult for consumers to keep up with cost of living only then to face historically high levels of inflation.

Make no mistake having a value-based merchandising strategy is part of Walmart’s eCommerce success. 66% of consumers surveyed said “best value for money” keeps them returning to a brand, taking the top spot in terms of consumer preferences. “Lowest prices” came in second and “fast shipping” came in eighth place.

Some of the most successful retailers today include Dollar General, Target, Costco and Walmart. Dollar General, for example opened nearly 1,000 stores last year. These retailers all target the low end of the pricing spectrum. Many consumers started shopping at discount retailers retailers during the 2008-2009 recession and kept shopping at these stores once the recession was over. This shift in shopping habits has negatively impacted retailers in the middle of the pricing spectrum like JC Penney, Sears, Gap and Kohl’s.

3. Consumers are looking for one stop shopping. It is not a coincidence that many of the retailers that have performed well over the last few years offer one stop shopping. From Walmart to Target to Costco customers are seeking refuge in retailers where they can get what they are looking for in one trip. What we are witnessing is a trend towards more convenient shopping trips. Why buy your grocery and household items online from several different retailers when you can save time by getting everything you need from Walmart.

The desire for one stop shopping is not new. Think about the days when Sears was the largest retailer in the world. Consumers would spend their Saturday afternoons at the mall getting everything in one trip. The fall of Sears and other department stores has only served to usher in a new kind of department store, the big box store. It has a different name but in many respects it serves the same function. Consumers can shop at a Walmart or a Target and get most of their weekly needs fulfilled without having to shop at multiple stores.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

4. Big investments are often required to succeed in eCommerce. eCommerce isn’t cheap. Customers love it but it’s costly for retailers. After Walmart suffered its first decline in sales in 2015 since 1970, it realized it had to be more aggressive. To increase its eCommerce growth Walmart purchased a host of eCommerce businesses including Jet.com for $3 billion (in 2016), Bonobos for $310 million (in 2017), Eloquii for $100 million (in 2018) and ModCloth for between $50 million to $75 million (in 2017).

Without this multi billion dollar investment it is hard to say where Walmart’s eCommerce business would be today. Some of those businesses have since been sold or discontinued but in the process Walmart gained know-how, processes and talent. Those investments don’t even include all of the money Walmart has invested in pickup services, fast shipping and its mobile app. When all of these services and accompanying technology works seamlessly with very little downtime it’s easy to forget the enormous amount of resources it takes to offer best in class eCommerce. Walmart doesn’t break out profits for its eCommerce business but it is estimated that in 2019 Walmart’s U.S. eCommerce business lost $2 billion. At a conference in 2022 Walmart’s CFO John David Rainey alluded to the fact that eCommerce is not a big profit driver for Walmart when he said that: "today, the vast majority of our overall profits are attributable to in-store brick-and-mortar in the U.S."

5. Frequently purchased items draw customers in week after week. Expenditures on food is the third largest consumer expense in the United States after housing and transportation. If a retailer sells groceries it can count on a steady flow of traffic. We now think of Walmart as a grocery retailer but when Walmart opened its first store in the 1960s it did not sell groceries. Expanding into groceries is largely credited with turning Walmart into the retail giant it is today.

Selling groceries increases frequency of visits since most consumers shop for groceries on a weekly basis. After a consumer shops for groceries at any of the big box retailers they will often browse and then purchase other items. How many times have consumers bought a TV at Costco on their way to pick up some broccoli?

Amazon has also recognized this dependency, with Amazon’s former CEO Jeff Bezos saying over a decade ago that for Amazon to become a $200 billion retailer it has to figure out how to sell food. Amazon has surpassed that sales goal and with that in mind it should be no surprise that Amazon bought Whole Foods in 2017 or that it opened a new grocery chain in 2020.

Core to any eCommerce business is website traffic that returns on a frequent basis. Facebook marketing budgets eventually run out so it’s better to create an intrinsic reason for customers to return as much as possible. Retailers do this by constantly dropping new merchandise making customers eager to see what’s new. But an even better strategy is to tie traffic to an activity customers are already doing. There really isn’t a better frequent shopping activity than buying groceries. Everyone does it because they have to. I don’t need to see a sponsored ad in my Facebook feed from Walmart to remind me it’s time to buy groceries. I do it naturally. So if you want to know what’s better than Facebook marketing it’s called a routine that every consumer conducts every week forever that brings them to your website.

6. A growing online marketplace and advertising business. When you shop on Amazon there is merchandise Amazon buys and resells at a markup (first party sales) and there are goods third party sellers sell directly to you. These sellers are often small to medium sized businesses sometimes retailers you have never heard of and they pay Amazon a commission on every sale. At some point Amazon realized it could make more money by creating a marketplace of third party sellers and around 60% of Amazon’s unit sales come from these sellers.

If you watch Amazon for long enough you can come up with some good ideas for what to do with your own business. Clearly Walmart is watching and now it’s building its own marketplace of third party sellers which you can find by shopping on walmart.com. Walmart has over 100,000 of these sellers which pales in comparison to the over two million sellers that sell merchandise on Amazon. But Walmart now has over 400 million SKUs on its online marketplace and growing this business has several benefits. “Our marketplace expands choice for our customers, helps our sellers grow, and enhances our profit margins,” said McMillon.

More third party sellers also helps to grow advertising sales. If you shop on Amazon you will notice the number of sponsored ads are growing. These are ads that third party sellers often pay for to increase the discoverability of their products. Those ads amount to big dollars, so big, Amazon had to announce the size of its advertising business for the first time in 2022. Amazon made $47 billion in advertising sales last year that’s more money than most retail chains make.

With Amazon’s burgeoning ad business a badly kept secret for many years Walmart took notice and started to invest in its own. “Globally, it's been growing at a high rate with high margins and is now a $2.1 billion business [in 2021, Walmart’s ad business generated $3.2 billion in 2023] in only a few years. And we expect this strong growth to continue. And as our e-commerce business, including marketplace, continues to grow, so will our advertising business,” said McMillon. “I think that's the headline. We've got a business that's becoming increasingly digital, the e-commerce business, first party -- third party is growing. It gives us the opportunity to grow advertising income. It's grown at a fast rate,” said McMillon.