Retail Trend to Watch: the Hollowing out of Mid-Priced Retailers

In many ways the COVID-19 pandemic has only accelerated trends already taking place in the retail sector. One of those trends is the squeezing out of retailers targeting the middle of the pricing spectrum, like Gap or JC Penney that aren’t too expensive or too cheap. Between 2012 and 2017 sales at retailers in the middle of the pricing spectrum increased by only 2% while sales at premium and price-based retailers in the United States increased by 81% and 37% respectively during the same timeframe.

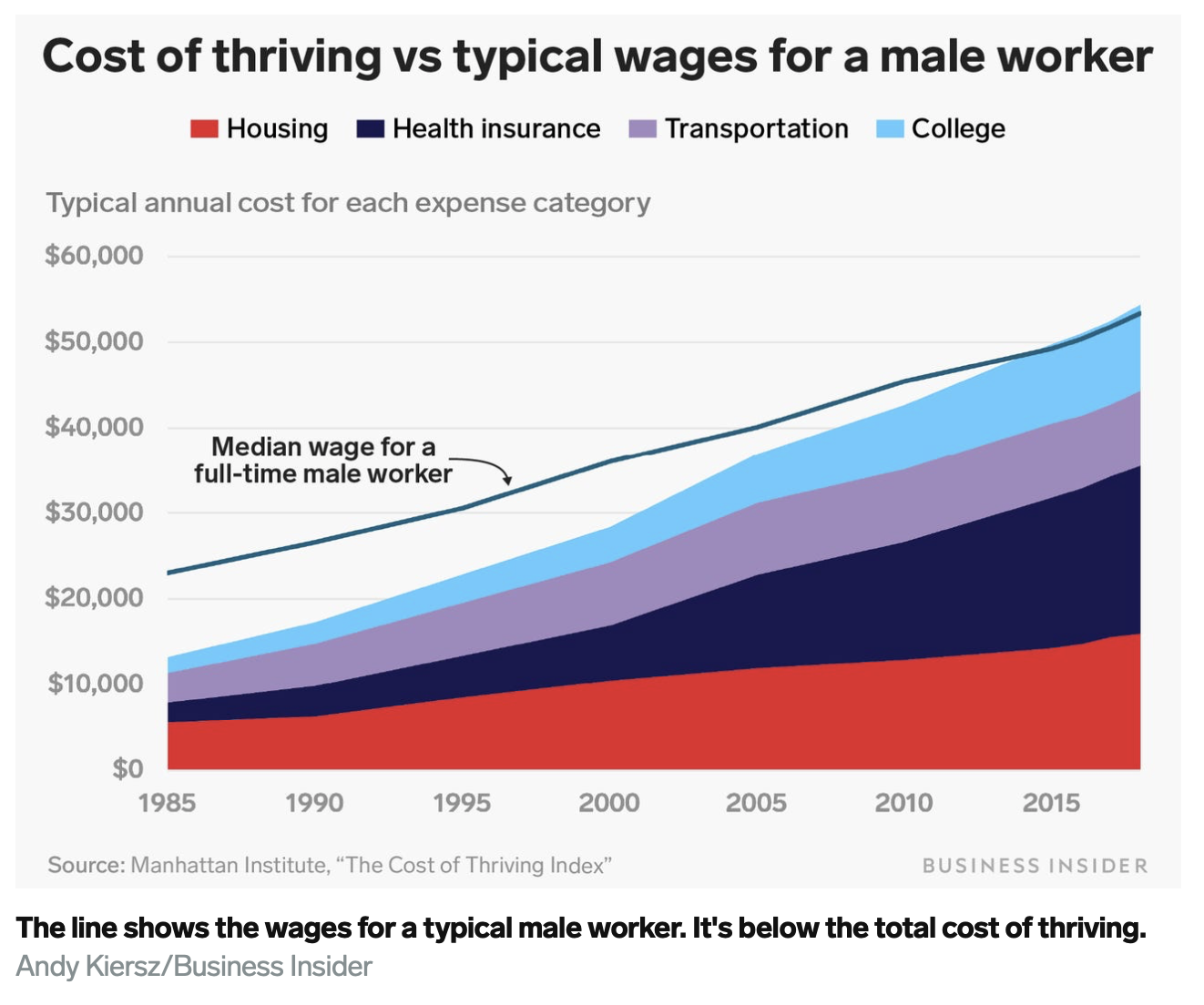

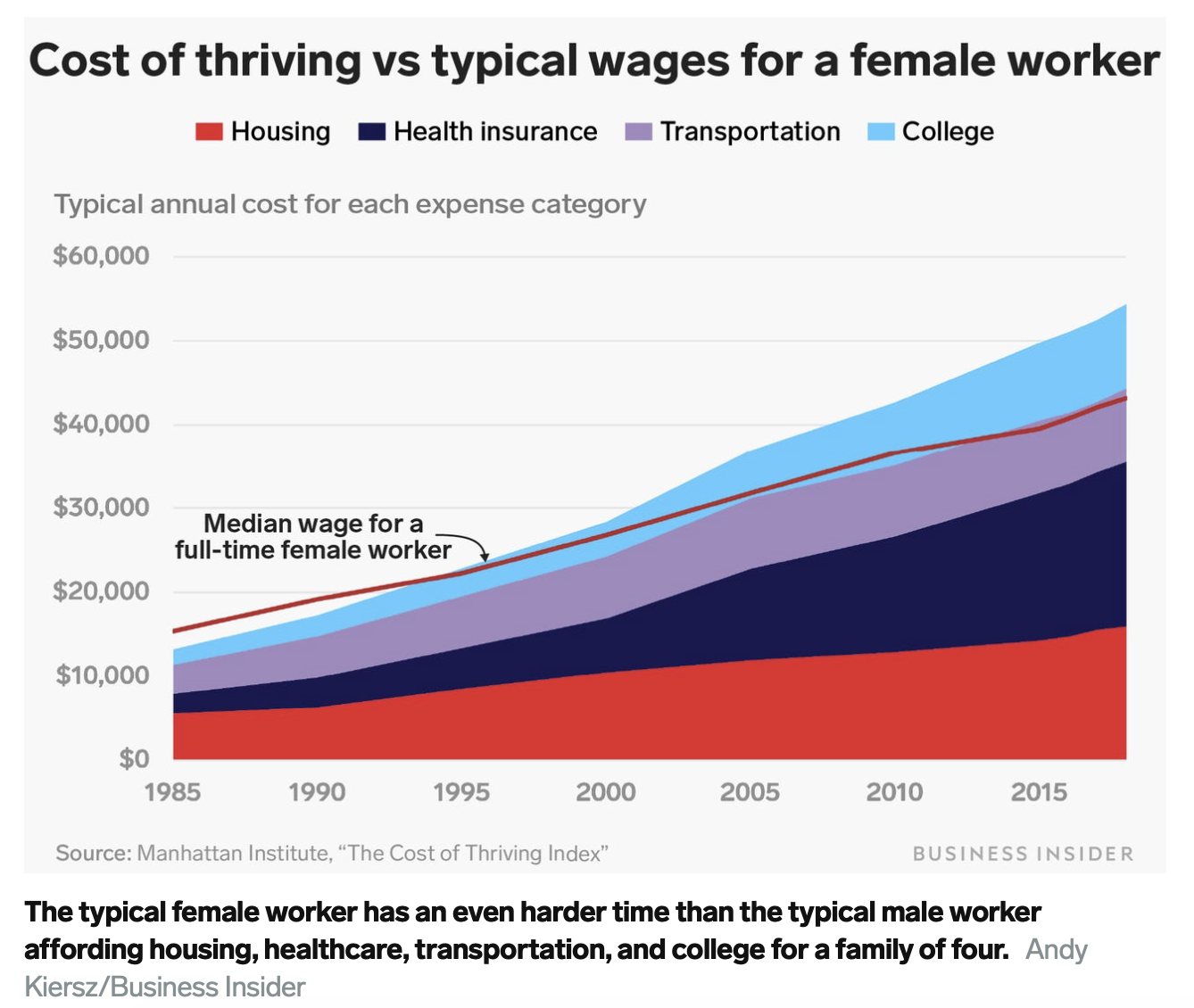

While increasing competition from online retailers is often cited as the reason middle tier retailers are suffering the main reason has to do with economics. In 1985 it took a male breadwinner 30 weeks to pay for critical expenditures like housing, healthcare, transportation and education. By 2018 it took 53 weeks. The situation is even worse for female breadwinners who in 1985 took 45 weeks to cover those expenses and needed 66 weeks in 2018. You can do the math, there isn’t enough money to go around. Since the 1970s healthcare costs in the United States have grown by $9,000 and the price of homes have grown by 39% making it challenging for the average American family to feed their children.

As you can see in both charts, both male and female breadwinners are living below the cost of living line. What does all of this mean? Consumers have less money to buy many of the items retailers sell. And when they do make a purchase they are choosing lower priced retailers over middle tier retailers out of necessity. COVID-19 is like a double whammy since many consumers reigned in their spending habits after the last recession hit and never looked back. Now with the pandemic the situation is even worse. More than 40 million Americans have filed for unemployment since the pandemic hit meaning discretionary income is even harder to come by.

It is telling that even before the pandemic, Todd Vasos Dollar General’s CEO said: “the middle-class continues to go away, unfortunately, to the lower end of the economic scale versus the higher end.” “So as this economy continues to chug along and creates more of our core customer, I think there’s going to be more and more opportunities for us to get in and build more stores.” If only he knew how right he would be.

Let’s not forget that the largest retailer in the world is Walmart. The three largest clothing retailers in the world are Zara, Uniqlo and H&M which all sell lower priced merchandise. Then there are dollar stores. The two retailers with the highest number of store openings in 2019 were dollar stores. Dollar General opened 975 stores and Dollar Tree opened 500 stores in 2019. This shows how much consumer spending has shifted to lower priced retailers before the pandemic even started.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

It’s not just about price. Mid-tier retailers have also suffered from poor assortments. Retailers like Uniqlo and Zara have done a much better job of selling on trend items (and at lower prices). If I need to buy a new summer dress am I going to go Hudson’s Bay department store or to Zara? Zara is the likely choice most of the time. But that only tells part of the story. How good does your assortment need to be? If you just look at the United States, the top clothing retailers are Amazon and Walmart. Coresight research has said that Amazon did this by: “penetrating the heart of the mid-market”. This shows how much consumers are focused on value. If you don’t have the best assortment then you had better have the best prices or you are going to loose customers.

On the higher end of the spectrum it is true that the rich keep on getting richer. Between 1979 and 2014 the incomes of the middle class increased by 28% while incomes of the top 20% increased by 95%. That is good news for luxury retailers.

In the future more of the retail sector will be concentrated in the upper and lower ends. This means if you are Gap and you are stuck in the middle you need to find a new value proposition and fast since what worked in the past won’t work in the future.