Forever 21: 4 Reasons it Failed & Filed for Bankruptcy

Forever 21 used to be top of mind for teens and twenty somethings but then things slowly began to change. New ultra fast fashion competitors like ASOS and Boohoo entered the market and did what Forever 21 did but better. Not only are these retailers fast to market with their trendy designs they are also skilled eCommerce operators. Instead of bracing itself for the onslaught of savvy online rivals Forever 21 continued to do what made it successful in the first place.

A collection of missteps ultimately sealed the retailer’s fate with Forever 21 filing for bankruptcy in 2019 and in 2020 Forever 21, which once generated $4 billion in sales, was sold for $81 million to Authentic Brands Group (which owns many brands including Barneys New York, Aeropostale and Nine West) and real estate companies Simon Property Group and Brookfield Property Partners. If you are curious about why Forever 21 had such a fall from grace consider these four factors.

1. An inability to stay ahead of the competition. Retail is littered with stories like this one, about companies that were once at the top but are no longer relevant. Think Sears. After Forever 21 opened its first store in 1984 in the United States fast fashion started to gain in popularity. It was easy for Forever 21 to capture the hearts and minds of young consumers looking for trendy apparel. Although clothing is a department store staple retailers like Sears or specialty retailers like Gap couldn’t keep up with a more nimble fast fashion retailer like Forever 21.

In the beginning Forever 21 had the fast fashion market largely to itself in the United States with Zara only entering the United States in 1989. It wasn’t until a little over 10 years after Zara showed up in America did H&M open its first store 2000. Something has to be said about a first mover advantage, it makes things easier. Without a lot of competition Forever 21 was able to grow largely unchecked. Then things began to change. In the 2000s the internet met fast fashion, and a slew of new competitors began to emerge. Now popular online fashion retailers began to popup with ASOS launching in 2000, Boohoo and Fashion Nova launching in 2006 and Shein launching in 2008.

One defining characteristic of these online retailers is that they are fast to market, so fast they are called ultra fast fashion retailers. Fashion Nova is able to design and manufacture a clothing item in as little as 48 hours and more than 1,000 new styles are added on Fashion Nova’s website each week. Shein, another ultra fast fashion retailer, adds between 2,000 and 10,000 new items on its website every day.

Shein is vertically integrated allowing it to go from design to shipping in as little as three days. Commenting on the growth of Shein TechCrunch wrote: “[Shein] manufactures in China as many apparel retailers do. The difference is Shein controls its own production chain, from design and prototype to procurement to manufacturing. Each step is highly digitized and integrated with another, which allows the company to churn out hundreds of new products tailored to different regions and user tastes at a daily rate. The strategy is not unlike TikTok matching content creators with users by using algorithms to understand their habits in real-time.”

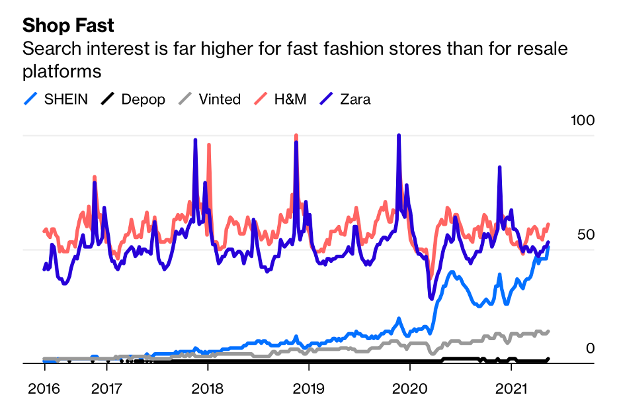

While many argue Forever 21’s demise is due to a more socially conscious consumer fast fashion retailers are as popular as ever. If you take a scroll through Instagram you will see just how many teens and millennials are wearing clothing from the likes of fast fashion retailers. Resale sites like Depop and Vinted are gaining steam but they are still a small fraction of the overall clothing market.

Source: Bloomberg

"[Forever 21] has lost much of the excitement and oomph which is critical to driving footfall and sales and is now something of an also-ran which is too easily overlooked," said Neil Saunders, the managing director of GlobalData Retail.

2. An inability to leverage social media effectively. What ultra fast fashion companies have done really well is figure out how to leverage social media. Ultra fast fashion brands embraced social media and reality TV stars like Cardi B and Kylie Jenner earlier than mainstream brands like Forever 21. Both of these stars were seen modelling Fashion Nova clothing on their own Instagram accounts and Cardi B has also had her own Fashion Nova clothing line. This speaks to the fact that ultra fast fashion brands have not only been ahead of the curve on emerging clothing trends but also on the power of influencers before they became as widely used as they are today.

Laura Illanes, a 22-year-old student at the University of South Carolina Upstate, said she gets six free pieces of clothing from Shein each month for promoting the brand to her Instagram followers. Shein has grown very fast becoming the most downloaded shopping app on iOS and Android in the United States in May of 2021 with Amazon coming in second. Shein’s app has been downloaded over 200 million times, while H&M’s app has been downloaded over 100 million times and Zara’s app over 90 million times.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

3. Aggressive store expansion and failure to adapt to eCommerce. Forever 21 put its eggs in one basket and focused on aggressive store expansion to fuel growth. “We went from seven countries to 47 countries within a less-than-six-year time frame and with that came a lot of complexity,” said Linda Chang, Forever 21’s former executive vice president and daughter of the founders of Forever 21 .

At the time it filed for bankruptcy Forever 21 was one of the largest mall tenants in the United States. Stores are still very important in the apparel sector generating the majority of sales but the growth of online sales meant that retailers needed to think about what the optimal mix of in store versus online sales should be and invest accordingly. Like Sears and Neiman Marcus, Forever 21 simply did not react to changes in the market fast enough. By 2018 Forever 21’s online sales were only 16% of total sales.

Even Zara has admitted it needs to strike the right balance across online and offline channels. Inditex, Zara’s parent company planned to close up to 1,200 stores by the end of 2022 and open 450 new stores. 2020 marked the first time Inditex ended a year with fewer stores than when it started the year. But stores will continue to play an important role in Zara’s strategy. Overall, "the overriding goal between now [2020] and 2022 is to speed up full implementation of our integrated store concept, driven by the notion of being able to offer our customers uninterrupted service no matter where they find themselves, on any device and at any time of the day," said Pablo Isla Zara’s former CEO. By the time Forever 21 realized the importance of online sales it was too late.

Not only was Forever 21 expanding its store fleet too aggressively at the wrong time it was also opening stores that were too large. Some of Forever 21’s stores were over 100,000 sq. ft. with the largest, a 150,000 sq. ft store in Fresno California. Forever 21 even purchased space vacated by retailers like Sears and Mervyn’s. Large stores are inherently risky. In addition to rent you have to pay for employees to staff the store and you need enough merchandise to fill the store. If you can’t move all of the inventory then markdowns are required which eats into sales per sq. ft. and ultimately profitability. “Having to fill those boxes on top of having to deal with the complexities of expanding internationally did stress our merchant organization,” said Chang.

Many of Forever 21’s stores were unprofitable. Between 2018 and 2019 Forever 21’s stores in Canada, Europe and Asia lost approximately $10 million per month. “Forever 21 opened stores at the beginning of the upswing of fast fashion, and they were able to capitalize on the upswing,” said Farla Efros, president of consulting firm HRC Retail Advisory. “Quickly they began to open stores, more like mini-department stores that were too large and quickly became unproductive. Given the growth of online [retail] at the same time, the larger boxes became quite undesirable to the consumer. The infrastructure cost became too expensive.”

4. Not enough focus on the core business. As time went on Forever 21 began to expand outside of its core apparel business at a time when it should have stayed closer to home. In 2014 Forever 21 opened F21 Red which sells even cheaper basics targeted at the whole family. If you are shopping at F21 Red you can pick up a camisole for less than $2.00 or a t-shirt for less than $4.00. By 2017 Forever 21 decided it would open 40 F21 Red stores within that year alone. But in 2017 some F21 Red stores were only generating revenues that were half of projected sales. The expansion was planned even though Forever 21’s sales were flat in 2016.

Then in 2017 Forever 21 opened Riley Rose a beauty store selling Korean beauty products aimed at Millennial and Gen Z consumers. Riley Rose stores became a money losing venture. Forever 21 was focusing on expansion at a time when its core business was losing steam. By 2019 Forever 21’s sales declined from a peak of $4.4 billion in 2016 to $3.1 billion in 2019. All of the more than 100 Riley Rose stores were shuttered during bankruptcy proceedings. “We lost our market positioning as we took our eyes off of the ball,” says Chang.

Since filing for bankruptcy Forever 21 has remerged and has hundreds of stores across the United States.