5 Fast Growing Retail Segments Poised for Success

In spite of all of the challenges that came along with the COVID-19 pandemic the retail sector managed to grow at a rate of 2.9% last year in the United States. One of the retail segments that is glowing at a faster clip than others is discount stores. With millions of Americans unemployed and struggling to make ends meet consumers want value for money and discount stores are providing it. Take Dollar General. While many retailers are reducing their footprint Dollar General is planning to open 1,050 stores in 2021.

Targeting price conscious consumers is clearly a bright spot but it is not the only one. The pandemic has bolstered eCommerce sales and a surprising beneficiary of the growth in eCommerce last year are traditional retailers like Walmart and Target. With an extensive store network they are able to provide omni-channel services consumers desire like click and collect in in away smaller retailers and even Amazon cannot. If you would like to know where to place your bets in the retail sector then consider these five areas that are growing quickly.

1. Discount stores

Even though the great recession took place more than a decade ago its aftermath still looms large over the retail sector. With less disposable income consumers flocked to discount stores like TJ Maxx and Ross Stores during the recession of 2008-2009. Once the great recession ended consumers who became addicted to the thrill of a good deal kept shopping at these stores. This behaviour is not surprising when we look at what has happened to real wages over the past decade and a half. According to The Pay Scale Index: “since 2006, wages have risen 16% overall in the United States But when you factor in inflation, “real wages” have actually fallen 9%. In other words, the income for a typical worker today buys them less than it did in 2006.” The pandemic has only served to accelerate these trends.

Today retailers within the discount sector are in the right place at the right time. Consumers are thriftier and are focused on value for money. As discount stores continue to thrive they have slowly but surely eaten away at retailers like department stores that are stuck in the middle. Why shop at Macy’s if you can find something just as great but at a lower price point at Target? Everyone likes a good bargain and stores like Target offer that.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

2. eCommerce

In 2020 it is expected that eCommerce sales will have grown by 32.4% in the United States. A lot of this growth was driven by the pandemic which forced many consumers to try things like shopping for groceries online for the first time. Making the headlines last year was not just Amazon but the eCommerce growth of more traditional retailers like Target. Target’s eCommerce business is now the seventh largest in the United States and its eCommerce sales were up by an estimated 103.5% in 2020. “Store renovations and expanding same-day fulfillment options, such as in-store pickup, drive-up and delivery with Shipt, are paying off. Target has found a way to use its stores to fulfill online orders while keeping up with customer demands for convenience and speed,” says eMarketer Analyst, Cindy Liu.

The fastest growing eCommerce category is food and beverage followed by health, personal care and beauty. In 2020 food and beverage eCommerce sales grew by an estimated by 58.5%. In 2020 online sales of health, personal care and beauty products grew by an estimated 32.4% as many consumers leaned into skincare while stuck at home.

3. Resale

It is estimated that the resale apparel market will double from $24 billion in 2018 to $51 billion by 2023. Part of this growth is due to consumers seeking more sustainable options in an effort to protect the environment. 1.2 billion tons of greenhouse gas emissions are produced each year as a result of textile production and donating or reselling clothing is a way for consumers to become more environmentally friendly. A survey of resale platform Vestiaire Collective’s members found that 54% purchased or sold an item on the site because they wanted to shop in a more sustainable manner.

Shopping secondhand also allows consumers to trade up and buy that Gucci bag they normally would not be able to afford. Secondhand clothing is especially popular amongst millennial and Gen Z consumers who buy secondhand items more than twice as much as the average consumer. In addition to having an affinity towards sustainable causes, the fixation with Instagram amongst these consumers has also boosted the resale market. Young consumers interested in building their online audience want to have a constant rotation of outfits to pique the interest of their followers. The ability to buy cheaper resale clothing or to easily sell one’s closet online provides a source to fund a constant rotation of outfits.

Many also consider reselling clothing or sneakers a lucrative side hustle with some turning this part-time gig into a full-time job. Resale platforms such as Poshmark, The Real Real and ThredUp which make buying and selling online easy are facilitating the growth of this segment. 50 million people use Poshmark and 5 million of those users are sellers. Poshmark has made $2 billion in payouts to sellers.

4. Home fitness

If you are still searching for dumbbells to take your home workout to the next level you are not alone. With many gyms closed because of the pandemic the home fitness sector is growing quickly. From workout apps to workout equipment many segments of the home fitness category are surging. You can tell a sector has a lot of potential when Apple enters it. In December Apple launched Apple Fitness+ a subscription workout service. To use the service you don’t need a leg press machine or a smith machine, there are plenty of exercises that require only your body weight or a pair of dumbbells.

Apple Fitness+ is not the only fitness app drawing consumer attention. Between January 2020 and November 2020 2.5 billion health and fitness apps were downloaded. That’s a 47% increase from 2019 when nearly 2 billion health and fitness apps were downloaded. Since consumers were downloading fitness apps in large numbers before the pandemic it means this trend has legs. For example, the most downloaded fitness app in 2020 is an app called Home Workout – No Equipment. It was downloaded 44 million times up from 22 million downloads in 2019. The Home Workout – No Equipment app provides daily routines for every muscle group and as the app’s name suggests all exercises can be done with your body weight. Not everyone can afford a gym membership so these apps give you an easy and affordable way of staying fit.

Then there are the fitness enthusiasts that have shelled out thousands of dollars on high end fitness equipment like a Peloton bike. After making an investment like that you are going to want to make the best of it. All of this bodes well for sales within several segments in the fitness category. For example, between June and November of last year treadmill sales were up 127%, stationary bikes sales were up 221% and free weight sales were up 97%.

Fitness enthusiasts are still going to want to go to the gym to take advantage of group fitness classes or more advanced equipment. But for the millions of people who tried working out from home during the pandemic and liked it they may continue their at-home regime in the future.

Many gyms realize a hybrid model of digital classes and on-premise training is going to be what consumers chose in the future and have beefed up their online offerings. “A legacy of the pandemic is that people know how to juggle various things at home now. When the pandemic dies down, digital options will be a substitute they’re familiar with if they don’t have time to make it to the gym,” says, Chris Rondeau, CEO of the gym chain Planet Fitness. “It’s ingrained in habits now.”

5. Home improvement

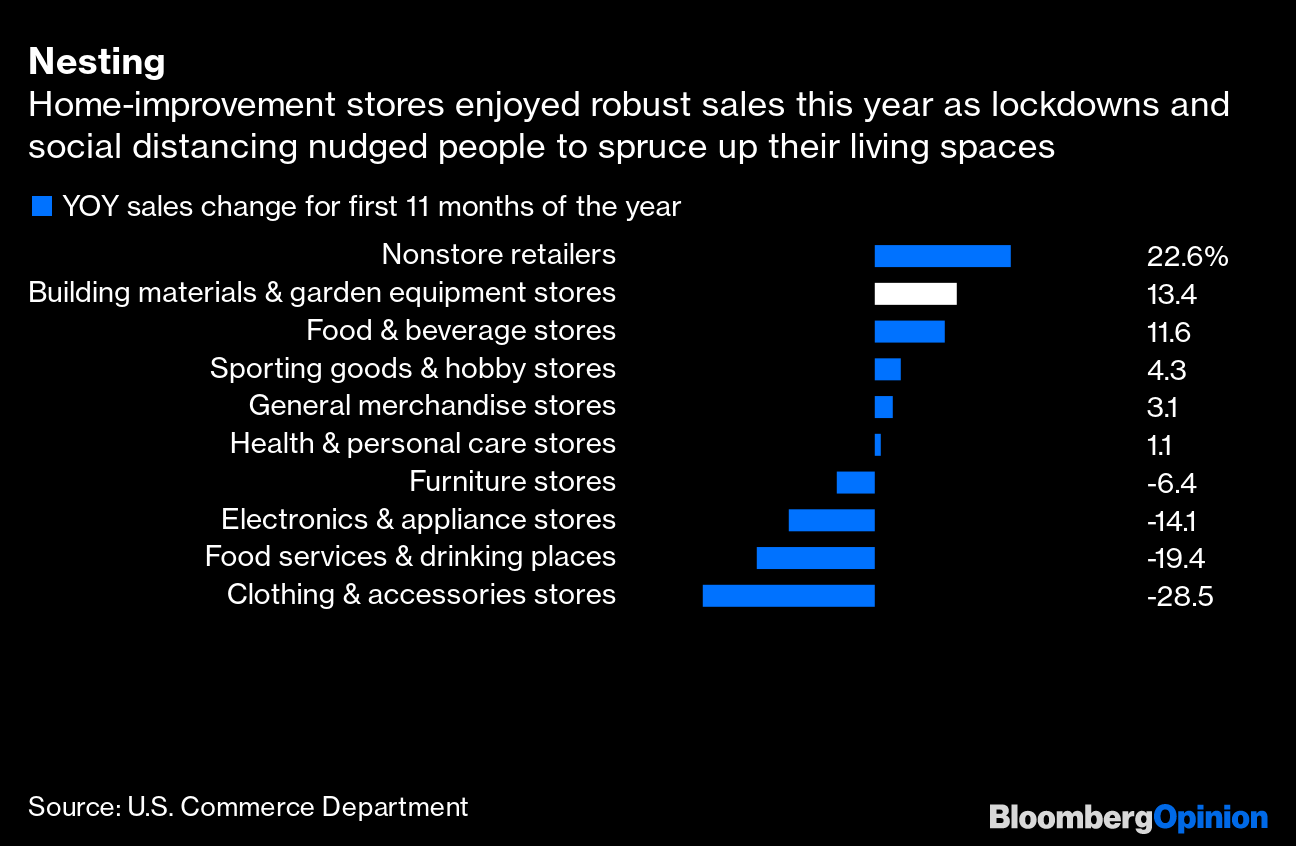

With millions of people spending more time at home due to the pandemic, the home improvement category has taken off with sales at building materials and garden equipment stores like Home Depot up 13.4% in the first eleven months of last year.

Consumers are using disposable income they normally would have spent on travel, eating out and events on improving the space they spend the most time in, their home. Building pools, spas, decks and home offices are among some of the most popular home improvement projects. It is expected this DIY trend will continue after the pandemic as consumers have raised their expectations for their home dwellings and as more employees continue working remotely.

“DIY customers are re-engaging with their homes and with The Home Depot in a meaningful way, and they are engaging across the store,” says Home Depot CEO and President Craig Menear. “We’ve seen strong demand with exterior projects like building decks, sheds, fences and gardens. We’ve also seen strong growth with interior projects, like hard-surface flooring, interior lighting and painting, to name a few.”

Some experts believe the home improvement market will cool off by the middle of this year but the truth is that no one knows for sure when spending will normalize. “Given the ongoing uncertainty surrounding the broader impact of the pandemic, the timing on when we’ll reach a bottom in the remodeling market also remains unclear.” says Abbe Will, associate project director of the Remodeling Futures Program at Harvard. But in a survey commissioned by NPD Group it found that 40% of consumers have plans to continue with DIY home improvement projects after the pandemic is over.