How Retailers are Approaching Cryptocurrency

It’s getting harder for a day to go by without hearing someone talking about cryptocurrency. Is it just a fad or are you late to the game? That’s a question many retailers are asking themselves. They are also wondering if bitcoin will become widely used as a payment method or will most people just hold on to it for speculative purposes. Like many things that are new and hot everyone has a crystal ball and a prophesy.

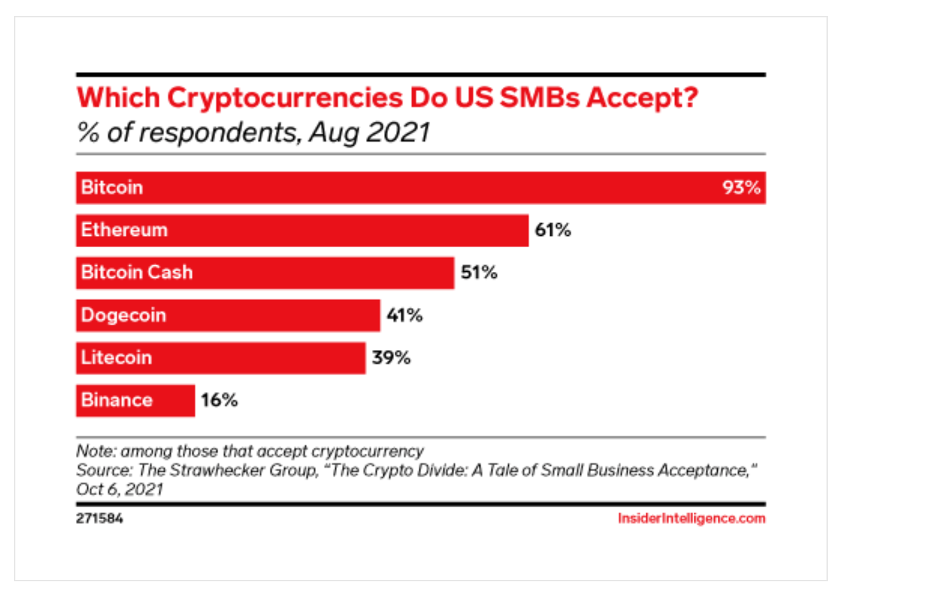

For now, very few small and medium sized businesses in the United States accept cryptocurrency, less than 10%. And only an estimated 1% of bitcoin transactions in the United States were for merchant services in 2020. For those small and medium sized businesses that do accept cryptocurrency bitcoin is the most popular followed by ethereum.

Why are retailers hesitant to accept payments in cryptocurrency? For one, cryptocurrencies like bitcoin experience wide fluctuations in value. In the first week of 2022 bitcoin’s value dropped by 11% and it’s down 50% from its high last fall. If a retailer holding bitcoin needs to convert it into cash today but bought it in the fall it will have to do so at a loss. Then there’s how consumers are affected by fluctuations in the value of digital currencies.

A CNBC reporter, Seema Mody, tried living off of bitcoin for a week in 2017. Then in 2021 she reflected on the purchases she made four years earlier using bitcoin. Mody bought an ice cream sandwich in 2017 with $6.50 worth of bitcoin. By 2021 that sandwich was worth $150. Mody also bought a salad at a French restaurant for $10 worth of Bitcoin in 2017 by 2021 that salad was worth $232.

Then there’s the famous example of Laszlo Hanyecz a programmer who bought two pizzas with10,000 bitcoins in 2010, worth $41 at the time. Those pizzas would now be worth close to a whopping $700 million at bitcoin’s high last fall. Now that’s the most expensive pizza in history. “You really don’t want to pay for your coffee with your bitcoin. You want to pay for your coffee with a currency,” said Michael Saylor, CEO of MicroStrategy and a bitcoin evangelist. “I don’t really think it makes sense to pay for things with an appreciating asset. It makes sense to pay for things with a depreciating currency.”

When asked if cryptocurrencies will replace cash, Dan Doley, a financial technology analyst for Mizuho Securities said “it’s not happening.” “I wouldn’t even try to quantify it because it’s so insignificant. People are buying crypto because they think it can only go up. Or because they’ve heard it’s the future. Or because they don’t know why they’re buying it.” But Jack Dorsey, CEO of Block believes bitcoin will eventually replace the United States dollar. He passed that feedback along on Twitter for the world to see in a conversation with rapper Cardi B in December.

In September El Salvador became the only country in the world where bitcoin is legal tender (along with the United States dollar). The news did not go down well with the International Monetary Fund which released a statement earlier this week recommending the country stop using bitcoin as legal tender. With all of this uncertainty what’s a retailer to do? Take a look at the moves these retailers are making in the cryptocurrency space.

1. Walmart. In December Walmart made a number of trademark filings one of which covered the creation of Walmart’s own cryptocurrency. Last year Walmart also posted a job position for a digital currency and cryptocurrency product lead who will be responsible for developing the retailer’s digital currency strategy. Walmart doesn’t accept cryptocurrency at the moment but Walmart has said it is open to doing that if that’s what customers want.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

2. PacSun is a clothing retailer popular with Gen Z consumers. It accepts 11 cryptocurrencies including bitcoin and ethereum from online shoppers through BitPay a blockchain payment provider. Alfred Chang, PacSun’s co-CEO believes this move will help PacSun stay relevant with its young customer base. Cryptocurrency “is something that every one of our consumers in this generation has grown up with as part of the conversation,” said Chang. It’s “really hard right now to believe that cryptocurrency is not going to mean something.” “The question mark is at what scale and exactly how,” said Chang.

3. Tesla. Last January Tesla announced it had purchased $1.5 billion worth of bitcoin and started allowing customers to buy Teslas in bitcoin. Then three months later Tesla CEO Elon Musk backtracked and said the electric car maker would stop accepting bitcoin due to the environmental impact of mining it. But recently Tesla started allowing customers to pay for some Tesla merchandise using dogecoin, a cryptocurrency. Items eligible for purchase using dogecoin include Tesla branded belt buckles and children's all-terrain vehicles. You cannot purchase a Tesla with dogecoin.

4. Starbucks. Starbucks has partnerships with Bakkt and PayPal which allow customers to reload their Starbucks’ card on the brand’s mobile app with a range of cryptocurrencies including bitcoin and ethereum. “We continue to nurture and deepen our direct personalized digital relationship with our members with enhancements to the program like Stars for Everyone to expand reach and through payment partnerships with PayPal and Bakkt, where a customer can now reload their Starbucks card with a range of cryptocurrencies including bitcoin, ethereum and others by converting digital currencies to physical currency and reloading their Starbucks card,” said Starbucks’ CEO Kevin Johnson.

El Salvador, where bitcoin is legal tender, is the only place where Starbucks’ customers can pay for their purchases directly using bitcoin.