Store Design Trend to Watch: More Convenient Store Formats

Walmart’s New Store Design

Long before the COVID-19 pandemic arrived and upended our lives consumers were strapped for time. There are more dual income households with both parents working and juggling parental duties and household responsibilities. If you feel like you are struggling to manage it all then you are not alone. The pandemic has only revealed and amplified this trend.

Several years ago retailers also spotted this trend and started to rethink store design. While there has been a lot of buzz about Amazon Go, those high-tech stores where customers check out without even scanning a single bag of apples the new store designs employed by retail giants like Walmart and Starbucks do not go that far. Technology is used to make it easier to find items at Walmart but a fully automated solution did not make the cut. Instead Walmart is focusing on retail 101: great way-finding including signage that pops. Starbucks locations are actually getting simpler while the retailer focuses more on mobile orders.

What will the store of the future look like? It’s anyone’s a guess but a mix of high and low end tech to make the shopping experience more convenient is the best path forward. Here’s what some of the most successful retailers are doing to redesign their stores and ultimately increase sales.

1. Starbucks

Does Starbucks have a crystal ball because last year, even before COVID-19 made grab and go a thing, Starbucks introduced a new store design in Beijing called Starbucks Now. This store format has very little seating and is tailored made for customers who just want to grab a coffee and go. Part of the impetus for the new store design was Chinese consumers who are already used to grabbing their coffee on the go.

When a customer enters the Starbucks Now location in Beijing they are greeted by a concierge station where a barista can help them either find their mobile order or place an order. Seating is limited and the store is not designed for customers planning to stay a while. The store is also used as a hub for coffee delivery orders. Starbucks Now stores cater to three types of customers: customers who order at the counter, customers who order by mobile and pick up in store and customers that order online and have orders delivered to them. “This new retail format and design approach provides us with a platform to offer customers a fast and convenient retail experience to suit their on-the-go lifestyle,” said Leo Tsoi, Chief Operating Officer and President of Starbucks China Retail.

A Starbucks Now location in Beijing China

A Starbucks Now location in Beijing China

A few months later, in November of last year, the first Starbucks Pickup location store opened in New York. Starbucks Pickup locations are based on the same premise as Starbucks Now locations. They are small but do not have seating but there is enough space to pick up mobile orders. Fast forward a year to 2020 and Starbucks is expediting the rollout of store formats that focus on convenience. Starbucks is planning to close 400 stores in North America by the end of 2021 and open 300 new stores this year with a focus on pickup and takeaway. 80% of Starbucks transactions are already “on the go” and in the first quarter of 2020 17% of Starbucks transactions in the United States were mobile transactions. "Our vision is that each large city in the US will ultimately have a mix of traditional Starbucks cafés and Starbucks Pickup locations," Starbucks said in a statement.”

Starbucks Pickup locations will be located in densely populated cities like New York, Chicago and Seattle while curbside pick-up, drive through and walk-up windows will be the priority for suburban locations. For curbside pickup, customers must order and pay in advance using the Starbucks app and then check-in to designated parking spots to receive their order. Starbucks is also testing curbside only locations. Starbucks plans to offer curbside pickup at as many as 1,000 locations. “By blending traditional Starbucks stores in dense markets with these new Starbucks Pickup stores optimized for the mobile order occasion, we not only improve the customer experience for those who want to sit in our store and enjoy their beverage but also create a great experience for those customers who want a convenient way to pick up their beverage on-the-go,” said Starbucks CEO Kevin Johnson in a letter to employees.

2. Chipotle

In an effort to increase digital sales Chipotle launched an initiative last year called Chipotlanes, its take on the drive-thu. Instead of ordering at a drive-thru window or by punching in an order at a kiosk outside, customers using Chipotlanes, order using Chipotle’s app or through the company’s website. No more sitting in front of a sign in the drive-thru pondering what to order, instead everything is done digitally before you even arrive at Chipotle. Once a customer has placed an order they drive up to the drive through window at a specified time to pick up their order. “It’s clear that customers appreciate the added convenience, because these stores generate digital sales far above the national average,” says Chipotle’s CEO Brian Niccol.

A Chipotlane

A key motivation for not having menu boards in Chipotle’s drive-thru is management’s belief that soon there will be a time when customers will not wait the average four minute wait time to be served at a drive-thru. Changing the traditional drive-thru design has required some additional communication with customers. “When we open up any store with a Chipotlane, we found we had to put people on the lot, tell them [there’s] no drive-thru, no speaker. You have to order ahead.” “There was some adoption rate for customers to understand. What we quickly found out was, after the first few days, customers get it,” says Chipotle CFO, Jack Hartung.

There is on average only a half a minute to minute wait time for customers using Chipotlanes. Stores with Chipotlanes are also smaller. “It’s mostly real estate,” says Hartung. “If you’re looking at a site in between two [existing] locations, if you can go into a 1,400- or 1,200-square-foot space, instead of 2,200, your investment goes down . . . real estate taxes go down . . . labor costs go down, too . . . [the] HVAC cost is lower. Generally, if we open up a small location with a Chipotlane, digital sales will be higher, and we need less labor.” This past August Chipotle opened its 100th Chipotlane.

3. Walmart

Walmart is the latest retailer to introduce a new store format and it is also focused on convenience. In Walmart’s new store design which was introduced this week it has prioritized wayfinding including signage. Taking inspiration from the airline industry, at the front of these newly designed stores customers are greeted with a store directory that looks similar to the signage found in airports.

Walmart’s new store design

“As customers enter the store, they are greeted with clean, colorful iconography and a store directory that encourages them to download and use the Walmart app while they shop,” said Walmart’s chief customer officer Janey Whiteside. “We’ve always known customers want to get in and out of a Walmart as quickly as they can. Not in a bad way. You don’t want to waste time.”

There are also large signs in key departments that say FRESH or Organic making them easy to find. And to take it to the next level customers can use Walmart’s app to direct them to the position in the store containing the item they are looking for. No more walking from aisle to aisle looking for harissa seasoning. Unlike some Walmart locations the newly designed stores have wide aisles making it even easier to find what you want.

Walmart’s new store design

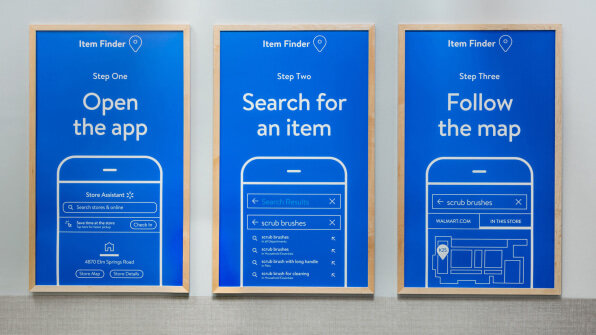

Signage inside of a Walmart showing customers how to use the Walmart app to find items

Outside Walmart has also erected large structures with signs to direct customers to the pickup area. While these stores are tech enabled the tech used is purposeful and not gimmicky. The goal is to get customers in and out as quickly as possible. Walmart will roll out the new store design to 200 Walmart stores by the end of 2020 and 800 by the end of 2021.

Walmart’s new store design

4. McDonald’s

Last summer McDonald’s introduced its largest restaurant format change since the drive-thru was launched in the 1970s. It opened a McDonald’s to Go store format in London. The restaurant format is takeout only. The décor is minimal, there is no seating and customers use touch screens on a wall to place orders. To keep lines short and focus on speed of service the restaurant only sells a few of McDonald’s signature items including: Big Macs, McNuggets, and fries.

Speaking about the new restaurant format, Henry Trickey, Senior Vice President for Development and IT at McDonald’s said: “in Fleet Street, where city workers are looking for something quick to grab and go, it makes sense to test a smaller format.”

A McDonald’s to Go location