The Top 5 Retail Trends to Watch in 2020 as COVID-19 Takes a Toll

In the retail sector the COVID-19 pandemic has highlighted vulnerabilities, accelerated underlying trends and shifted consumer behaviour in a way only a historic event can. The pandemic is swiftly having its way with retailers who have ebbed along for decades trying to stay relevant but are struggling to change. It has forced consumers desperate to buy essential goods to try online shopping for the first time. It is also causing a long awaited correction in the amount of retail space.

How big is the fallout? Retail sales in the United States are expected to drop by 10.5% in 2020 and will not rebound to pre-COVID-19 levels until 2022. Is it all bad? It depends on the way you look at it. In the short term the pain is real and deep with millions of people losing their jobs and a year of record store closings. But for some retailers this will be seen as a defining moment. One that caused them to dig deep and innovate like never before. For most it’s not a time to rejoice but the retailers that can see the light in the darkness may come out on the other side of this stronger than before. If it doesn’t kill you it makes you stronger may be the moniker for this time in history.

Amidst all of the change and chaos its hard to keep up but if you are trying, here are five of the biggest trends impacting the retail sector today and in the future.

1. The Hollowing out of Mid-Priced Retailers

One of the trends that has accelerated is the squeezing out of retailers targeting the middle of the pricing spectrum, like Gap or JC Penney that aren’t too expensive or too cheap. Between 2012 and 2017 sales at retailers in the middle of the pricing spectrum increased by only 2% while sales at premium and price-based retailers in the United States increased by 81% and 37% respectively during the same timeframe.

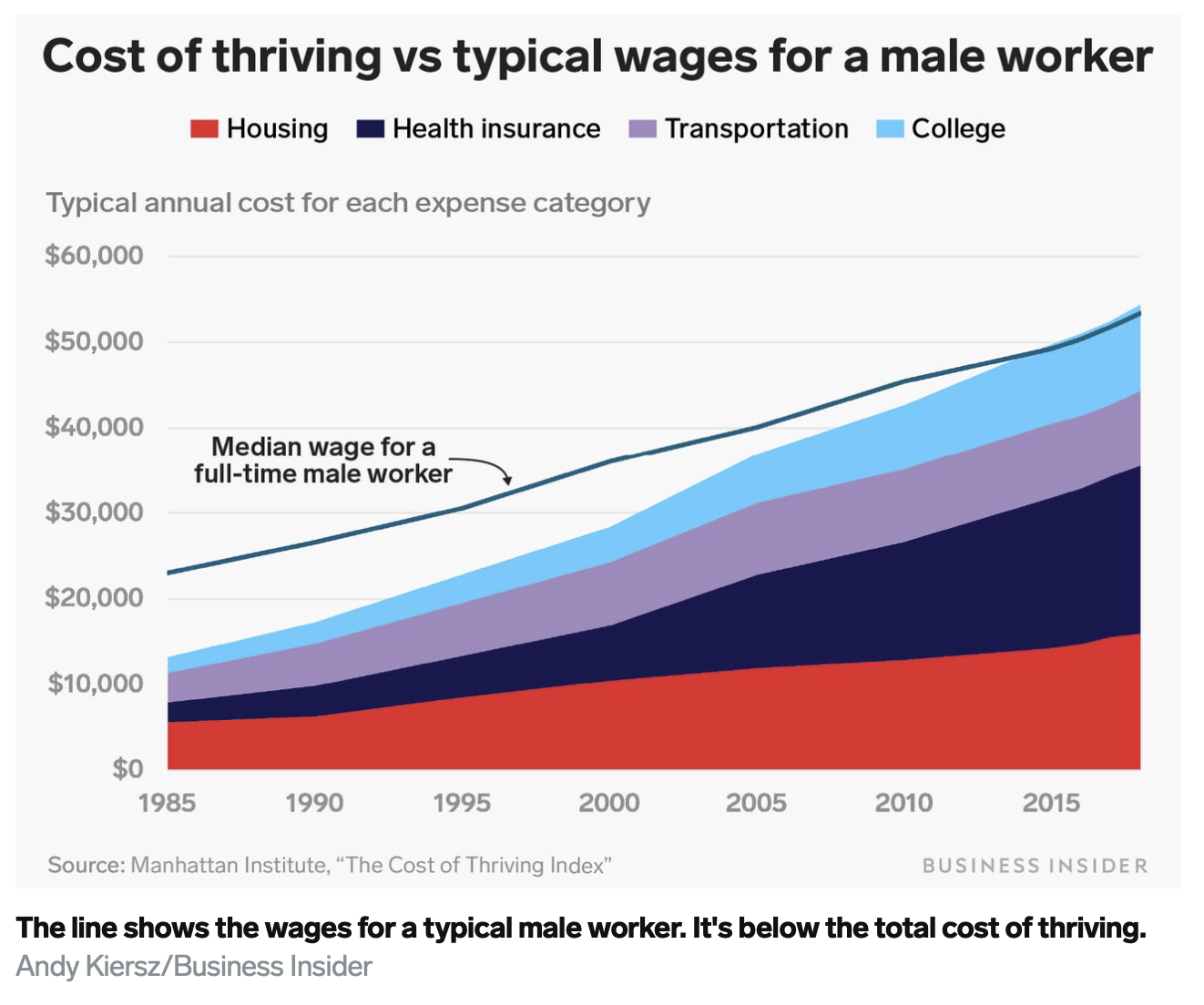

While increasing competition from online retailers is often cited as the reason middle tier retailers are suffering the main reason has to do with economics. In 1985 it took a male breadwinner 30 weeks to pay for critical expenditures like housing, healthcare, transportation and education. By 2018 it took 53 weeks.

As you can see in both charts, both male and female breadwinners are living below the cost of living line. What does all of this mean? Consumers have less money to buy many of the items retailers sell. And when they do make a purchase they are choosing lower priced retailers over middle tier retailers out of necessity. COVID-19 is like a double whammy since many consumers reigned in their spending habits after the last recession hit and never looked back. Now with the pandemic the situation is even worse.

It is telling that even before the pandemic, Todd Vasos Dollar General’s CEO said: “the middle-class continues to go away, unfortunately, to the lower end of the economic scale versus the higher end.” “So as this economy continues to chug along and creates more of our core customer, I think there’s going to be more and more opportunities for us to get in and build more stores.” If only he knew how right he would be.

Let’s not forget that the largest retailer in the world is Walmart. The three largest clothing retailers in the world are Zara, Uniqlo and H&M which all sell lower priced merchandise. Then there are dollar stores. The two retailers with the highest number of store openings in 2019 were dollar stores. Dollar General opened 975 stores and Dollar Tree opened 500 stores in 2019. This shows how much consumer spending has shifted to lower priced retailers before the pandemic even started.

On the higher end of the spectrum it is true that the rich keep on getting richer. Between 1979 and 2014 the incomes of the middle class increased by 28% while incomes of the top 20% increased by 95%. That is good news for luxury retailers.

2. Malls are in the Biggest Fight of Their Lives

Malls are the unfortunate beneficiaries of all of the destruction in the retail sector. The United States has the highest retail selling space per capita by a wide margin and the lowest sales per square footage of any country in the world meaning that the United States has too many stores. At some point consolidation was bound to happen but no one expected it to happen at such a fast pace this year.

14 out of 20 of the largest mall tenants are either department stores or apparel retailers, two of the hardest hit retail segments. Macy’s and JCPenney alone represent a little over 10% of all mall space in the United States. Since the pandemic started Neiman Marcus and JCPenney filed for bankruptcy and many expect that Lord & Taylor will be next. Once a department store falls the entire mall is at risk. One of these risks comes from co-tenancy clauses. These clauses state that if an anchor tenant is no longer there then other retailers can pay less rent or break the lease. “If the anchor tenants close stores in the mall, other tenants are likely to follow suit,” said Coresight CEO Deborah Weinswig.

Another risk is that department stores take up a lot of space. When a department store vacates a mall finding four to five other tenants to fill the space is not feasible in this environment and certainly there aren’t any new department stores looking to move in. The malls that will feel the impact the most are lower tier malls. Malls that are higher end, the ones with an Apple or a Nike store, are less likely to feel the impact of anchor tenants leaving but they are still suffering.

Mall based retailers have already started to flee. Five mall-based retailers: The Children's Place, Inditex (which owns Zara), Guess, G-III Apparel Group (which owns Calvin Klein), and Signet Jewelers announced more than 2,100 store closings within a single week earlier this month. It is estimated that when it’s all said and done between 20,000 and 25,000 stores will close in the United States in 2020. That is significantly higher than the 9,302 stores that closed in the United States last year, a year in which there was a record number of store closures. Between 55% to 60% of the store closures could occur in malls.

Many retailers have already stopped paying rent. Within enclosed regional malls in Canada, only 20% to 25% of tenants paid their rent in April of this year. “I’ve been in this business over 30 years and I have never seen anything as catastrophic or as impactful in a negative way in our business,” said Tim Sanderson, head of retail at JLL Canada, a brokerage. “It’s the mid-tier smaller-scale landlord that cannot make their mortgage payments to their lender that are going to be in trouble.”

The first regional mall in the United States to fail as a result of the pandemic is Northgate Mall in Durham, North Carolina. The owner of the mall, Northwood Retail, said: “the severe impacts of the COVID-19 pandemic, which has changed the way we live and socialize, has resulted in extreme financial difficulties experienced by a majority of our tenants and the property.”

Social distancing requirements which reduce the capacity in stores and malls even once the pandemic is under control means that retail sales are likely to languish until a vaccine is found. "We expect..the number of malls may eventually decrease to 800 or less from 1,200," said Cowen Analyst Oliver Chen.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

3. eCommerce Surges But is a Distant 2nd to Brick & Mortar

There is no doubt that the COVID-19 pandemic has caused a permanent shift in consumer behaviour. Many people who were reluctant to buy their groceries online because they wanted to see and touch their produce before buying it were forced to give grocery delivery a chance. If grocery delivery was not available during the pandemic many consumers tried curbside pickup for the first time and they liked it.

Target is one of several beneficiaries of this trend. In the first quarter of 2020 Target’s digital sales increased by a whopping 141% and it fulfilled close to 80% of those online orders in its stores. Target also had five million new customers during the first quarter of 2020 and over two million of them tried store pickup for the first time. “Certain eCommerce behaviours like online grocery shopping and click-and-collect have permanently catapulted three or four years into the future in just three or four months,” said eMarketer Principal Analyst, Andrew Lipsman.

While there is a lot of discussion about the surge of eCommerce sales during the pandemic overall eCommerce sales are not expected to grow dramatically faster in 2020. Overall eCommerce sales are expected to increase by 18% in the United States this year up four percentage points from last year. eCommerce sales of food and beverage and health/personal care/beauty will see huge spikes, growing at 58.5% and 32.4% respectively but the majority of retail sales still take place in stores and will continue to do so as the pandemic fades into the distance.

Exactly what is the expected volume of brick and mortar sales in the United States in 2020? Brick and mortar sales in the United States are expected to hit $4.184 trillion in 2020 while online sales are expected to reach $709.78 billion.

That means that only 14.5% of retail sales are expected to take place online in 2020 even with the crisis shifting behaviour.What does this mean? Even with high expected number of store closures don’t count out brick and mortar retail sales. The pandemic has shown how much consumers who have been stuck at home have missed being able to shop freely in retail stores. Expect the most successful retailers to continue to focus on their multichannel strategies. Walmart, the number one retailer in the United States, now has the second largest eCommerce business in America. One of the reasons for this is its large network of 4,600 stores that it has used to fulfill the demand of eCommerce orders during the pandemic.

4. Restaurants Struggle to Stay Afloat

Of all of the industries impacted by the COVID-19 pandemic the restaurant industry is one of the hardest hit. Nearly six million waiters, chefs, cashiers and other restaurant employees have lost their jobs in the United States since the pandemic began. While there has been widespread disruption, not all segments of the industry have been equally impacted.

Fast food restaurants have fared better during the pandemic. “Fast food restaurants were built for off-premise usage, with 70%+ of sales coming from drive-thrus,” says Stifel Analyst Chris O’Cul. “Fast food chains are also better positioned to promote value in the current environment where casual dining profits have been decimated,” he added.

By mid-April pizza restaurants were the only category seeing positive same store sales versus casual and fine dining restaurants which are struggling to stay afloat.

With razor thin margins restaurants depend on their premises being at capacity with a constant flow of traffic. But with social distancing requirements some restaurants have had to reduce capacity by more than 75%. "If you talk to restaurants across the globe, the language might change, but the math is the same," says Ryan Pernice, a restauranteur that owns Table & Main, Osteria Mattone and Coalition Food & Beverage in Georgia. "Restaurants and bars need volume and traffic to make them work." Another Georgian restaurateur, Blaiss Nowak, who owns a restaurant called Nowak’s, reflecting on the situation said: "there will be no profits for us while we are social distancing." "There are a great amount of restaurants that I've heard will never open again."

Independent restaurants which were already struggling before the pandemic will be the first ones to go. An estimated 30% of independent restaurants in the United States will never open again. Bars are also in trouble since they also depend on packed venues to make their numbers work. They are also the ones that have been the cause of COVID-19 resurgences in several places around the world. In South Korea a bar hopper went to five clubs during one night, tested positive for COVID-19 and then was found to be responsible for infecting over 100 people. These super spreaders thrive in crowded environments. After the incident occurred bars and nightclubs were closed indefinitely in Seoul.

The pain is unlikely to go away anytime soon as 60% of consumers say they plan to eat more at home and less at restaurants after the pandemic is over. When it is all said and done it is predicted that 20% of the over 650,000 restaurants in the United States that were in business in 2019 will not be open next year.

5. Steep Declines in Clothing Sales for the Foreseeable Future

We simply aren’t spending as much on clothing as we used to. In 1920 Americans spent 38% of their income on food and 17% on clothing. Today Americans only spend 10% of their income on food and they spend even less on clothing now, just a paltry 2.4%. Clothing and accessories sales in the United States are expected to decline by $100 billion this year,a 22% decline versus last year. Morgan Stanley believes the apparel market has “hit a ceiling” and is “going into structural decline.”

The pandemic has only accelerated this trend. 40% of consumers surveyed in the United States say they will reduce discretionary purchases to save money post COVID-19, which is not unexpected since millions of people are unemployed and whether you are unemployed or not the uncertainty created by the pandemic leaves consumers worried about the future.

Another blow to apparel sales is that most people aren’t going to buy new clothes if they have nowhere to go. Simon Wolfson, CEO of clothing retailer Next, explained the situation clearly when he said: “no one wants to buy clothes to sit at home in.” Next has been hit hard by the pandemic with its sales expected to drop by 25% this year. The underlying sources of apparel sales including events, parties, and office wear are heavily impacted by the pandemic reducing prospects for a quick recovery.

This May when retail spending increased by a month over month record of 17.7% in the United States it provided signs that a recovery is underway but concealed in the spending surge is how spending compares to May of last year. Retail sales in the United States declined by 6.1% in May of 2020 versus last year and apparel sales took the largest year over year hit of all categories by declining by 63.4%. This amplifies how much clothing and accessories stores are hurting and the end is not in sight.

You may also like:

The Future of Retail: 9 Ways Alibaba is Redefining Retail Stores

5 Reasons Walmart’s eCommerce Strategy is Winning

The Downfall of Sears, 5 Reasons Why it’s Struggling to Survive

The Reasons Behind Starbucks’ Great Customer Experience

eCommerce and its Profitability Issue. Why its So Hard to Make Money